Millions of Americans depend on federal benefit payments such as Social Security, SSI, SSDI, veterans benefits, and other government assistance programs. When a scheduled payment does not arrive on time, it can immediately create confusion and financial stress. Online searches often increase with questions like “Why was my federal benefit payment held?” or “Are my benefits canceled?”

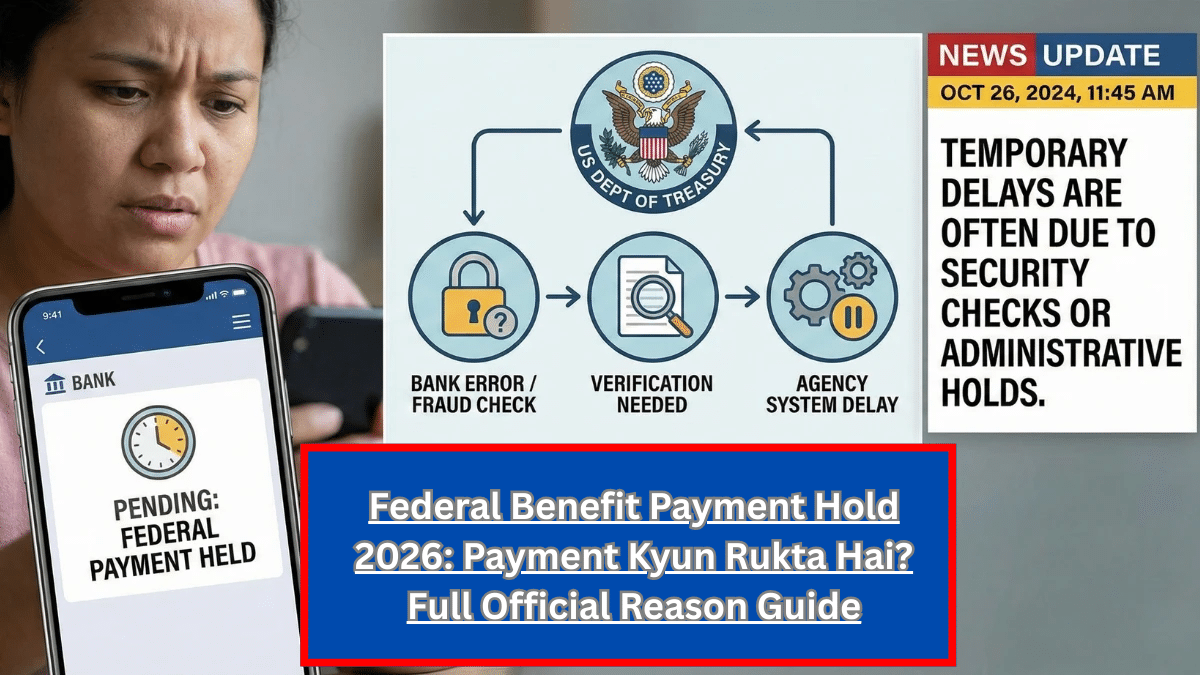

In most cases, a temporary payment hold does not mean cancellation, reduction, or permanent suspension. Federal agencies such as the Social Security Administration (SSA) operate under strict verification and compliance regulations. Payments may be paused temporarily to complete routine administrative checks, prevent fraud, or verify updated information.

This article explains the verified reasons federal benefit payments can be temporarily held, how long such holds typically last, what it means for beneficiaries, and what steps should be taken according to official agency procedures.

Key Highlights

Topic | Details

Main Reason | Administrative verification and compliance checks

Is Benefit Canceled? | No, unless official notice states otherwise

Common Triggers | Banking updates, identity verification, eligibility review

Resolution Time | Usually within one payment cycle

Missed Payment | Often released once issue is cleared

Official Communication | Written notice or secure online message

What a Temporary Federal Benefit Payment Hold Means

A temporary federal payment hold means that a scheduled benefit deposit has been paused while an administrative issue is reviewed. It does not mean the benefit has been removed from your record or permanently stopped. Instead, the agency temporarily withholds payment until verification requirements are completed.

Federal payment systems are designed with automatic safeguards. If the system detects changes in account information, identity records, or eligibility status, it may trigger a review flag. During this review, payments can be held to ensure compliance with federal regulations.

Once the issue is resolved, payments usually resume automatically. In many situations, the delayed amount is included with the next payment cycle. A hold is therefore procedural, not punitive.

Common Reasons Federal Benefit Payments Can Be Temporarily Held

There are several legitimate and routine reasons why federal benefit payments may be paused.

Bank Account or Direct Deposit Changes

If a beneficiary updates bank details, changes financial institutions, or modifies routing numbers, verification is required to ensure funds are sent to the correct account. This fraud-prevention step can temporarily delay the next payment.

Identity Verification Checks

Federal agencies use identity protection systems to prevent fraud. If discrepancies appear in personal records, additional verification may be required before payment is released.

Address or Contact Information Updates

Changing your mailing or residential address can trigger a system review. Agencies must confirm that official notices and payments are correctly routed.

Missing or Conflicting Documentation

If required documentation is incomplete or inconsistent with agency records, manual processing may be necessary. This can extend processing time slightly.

Periodic Eligibility Review

Programs like Social Security Disability Insurance and Supplemental Security Income require periodic eligibility checks. Income updates, work activity, or other qualifying factors may need verification before payments continue.

These safeguards exist to protect both beneficiaries and federal funds.

How Long Do Temporary Payment Holds Usually Last

In most situations, temporary payment holds are resolved within one payment cycle. For monthly benefit programs, this typically means the issue is addressed before or during the next scheduled deposit date.

Simple administrative updates, such as banking verification, are often resolved quickly once confirmed. More complex reviews, including identity checks or eligibility reassessments, may require additional documentation and therefore take longer.

However, even longer review periods do not automatically indicate benefit termination. Agencies must complete compliance checks before releasing public funds.

Does a Temporary Hold Mean Your Benefits Are Reduced?

No. A temporary hold does not reduce the benefit amount you are entitled to receive. The approved benefit calculation remains unchanged unless you receive a formal adjustment notice from the agency.

Federal law requires agencies to provide written notice before permanently reducing, suspending, or terminating benefits. If you have not received such notice, your benefit amount remains intact.

A hold only affects payment timing — not the official entitlement amount.

How Federal Agencies Notify Beneficiaries

When a payment is temporarily held, agencies typically notify beneficiaries through official channels:

• Mailed written notice

• Secure online account message

• Formal request for documentation

• Explanation of required next steps

Permanent benefit changes always require formal written communication. A temporary hold without cancellation notice usually indicates routine administrative review.

Step-by-Step Guide: What Beneficiaries Should Do If Payment Is Held

Step 1: Check Official Notices

Review mailed letters or log into your official benefit account to check for updates.

Step 2: Verify Personal Information

Confirm that your banking details, mailing address, and contact information are accurate.

Step 3: Allow Standard Processing Time

Wait until the next scheduled payment date before assuming a serious issue.

Step 4: Respond Quickly to Requests

If the agency asks for documentation or identity verification, submit it promptly to avoid further delay.

Step 5: Contact the Agency If Necessary

If no payment is received beyond the next cycle and no explanation has been provided, contact the agency directly for clarification.

Staying calm and following official procedures prevents unnecessary stress.

Why Federal Compliance Rules Require Payment Holds

Federal benefit programs operate under strict legal and financial oversight. Temporary holds help:

• Prevent identity theft and fraud

• Ensure payments go to the correct account

• Confirm eligibility compliance

• Protect taxpayer funds

• Maintain program integrity

These checks are not designed to penalize beneficiaries but to maintain system accuracy and security.

Focus Keywords

Why federal benefit payments are held

Federal benefit payment hold 2026

Social Security payment temporarily paused

SSA payment verification process

Federal benefit compliance review

Conclusion

Federal benefit payments can be temporarily held for administrative and verification reasons required under federal law. These holds are usually routine safeguards, not cancellations or reductions. Most issues are resolved within one payment cycle, and missed amounts are often issued once verification is complete.

Disclaimer

This article is for informational purposes only and does not constitute legal, financial, or benefits advice. Federal benefit payments are subject to official agency rules and verification requirements.

Written by our editorial team, committed to accurate and responsible reporting.