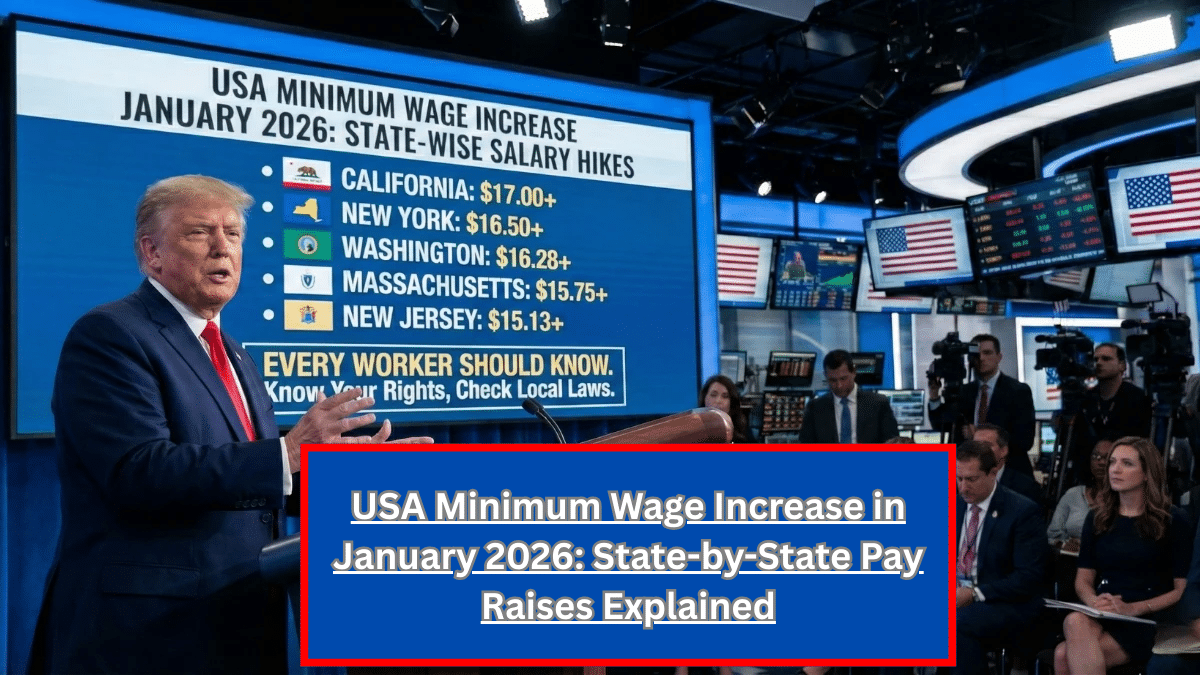

The USA minimum wage increase effective January 2026 is delivering state-wise pay raises for millions of workers. Several states are activating pre-approved wage hikes tied to inflation laws, voter initiatives, or phased legislative schedules. Because there is no single nationwide increase, it is essential for workers and employers to understand where wages are rising, who benefits, and how take-home pay may change.

Why Minimum Wage Is Increasing in January 2026

Many U.S. states adjust minimum wage rates every year using inflation-based formulas, while others follow voter-approved mandates or multi-year laws passed by state legislatures. Although the federal minimum wage remains unchanged, coordinated state actions—guided by standards from the U.S. Department of Labor—are driving wage floor increases in January 2026.

How State-Wise Minimum Wage Hikes Work

Each state controls its own minimum wage policy, which means increase amounts and eligibility vary by location. Some states implement automatic annual adjustments, others pause increases during economic review periods, and several apply different wage rates for large employers, small businesses, and tipped workers.

State-Wise Minimum Wage Increase Overview (January 2026)

| State Category | January 2026 Status |

|---|---|

| Inflation-indexed states | Automatic increase |

| Voter-mandated states | Scheduled hike |

| Legislative-approved states | Phased increase |

| Federal-only states | No state-level change |

Who Benefits Most From the January 2026 Hike

The largest benefits go to hourly workers, including entry-level employees, retail staff, food service workers, and part-time workers. Gains are especially meaningful in states where wages rise annually to keep pace with living costs and inflation.

How Salary Hikes Affect Employers and Payroll

Employers in affected states must update payroll systems, apply the new hourly wage floors, and adjust overtime calculations accordingly. Failure to implement the January 2026 minimum wage increase can result in penalties, fines, or labor law violations.

What Workers Should Check on Their Paychecks

Workers should review their hourly rate, pay stubs, and employer notices after January 2026 to confirm that the updated minimum wage has been applied correctly under state law.

Key Facts Workers Must Know

- Minimum wage increases are state-based

- Not all states raise wages in 2026

- Inflation laws trigger automatic hikes

- Employers must update pay rates

- Workers should verify January paychecks

Conclusion

The USA minimum wage increase starting January 2026 brings meaningful state-wise salary hikes for many workers. However, outcomes depend entirely on where you live, making it critical to understand your state’s wage laws and ensure that updated pay rates are correctly reflected in your paycheck.

Disclaimer

This article is for general informational purposes only and summarizes minimum wage changes; workers and employers should consult official state labor departments or legal professionals for exact wage rates and compliance requirements.

Written by our editorial team, committed to accurate and responsible reporting.