Concerns about Social Security garnishment in 2026 have grown due to online claims suggesting new enforcement waves, expanded eligibility, or sudden benefit seizures. These reports can sound alarming. However, there is no new garnishment program or rule change taking effect in 2026.

The rules governing Social Security garnishment are long-established and strictly limited under federal law. The process is administered under guidelines followed by the Social Security Administration (SSA), along with federal debt collection procedures.

This article provides a clear reality check—explaining when garnishment is legally allowed, who can actually be affected, and what has not changed heading into 2026.

Key Highlights at a Glance

| Claim | Reality |

|---|---|

| New 2026 garnishment law | ❌ No |

| Sudden benefit seizure | ❌ No |

| Expansion of eligible debts | ❌ No |

| Garnishment allowed for some debts | ✅ Yes |

| Full benefit can be taken | ❌ Never |

| Written notice required | ✅ Yes |

Has Social Security Garnishment Changed in 2026?

No. There are no new garnishment rules starting in 2026.

The legal framework that determines when Social Security benefits can be garnished has not been expanded, modified, or tightened. Any suggestion that 2026 marks a new enforcement rollout is not supported by official law, SSA announcements, or Treasury directives.

Garnishment authority continues to operate under the same federal statutes that have been in place for years.

When Social Security Benefits Can Legally Be Garnished

Social Security benefits are protected from most private creditors. However, limited garnishment has always been permitted for certain specific debts defined by federal law.

Debts That Can Legally Trigger Garnishment

| Debt Type | Garnishment Allowed |

|---|---|

| Federal income tax debt | Yes |

| Child support | Yes |

| Alimony | Yes |

| Federal student loans | Limited |

| Credit cards | No |

| Medical debt | No |

| Personal loans | No |

Private debts such as credit cards, payday loans, or medical bills cannot garnish Social Security benefits under standard federal protections.

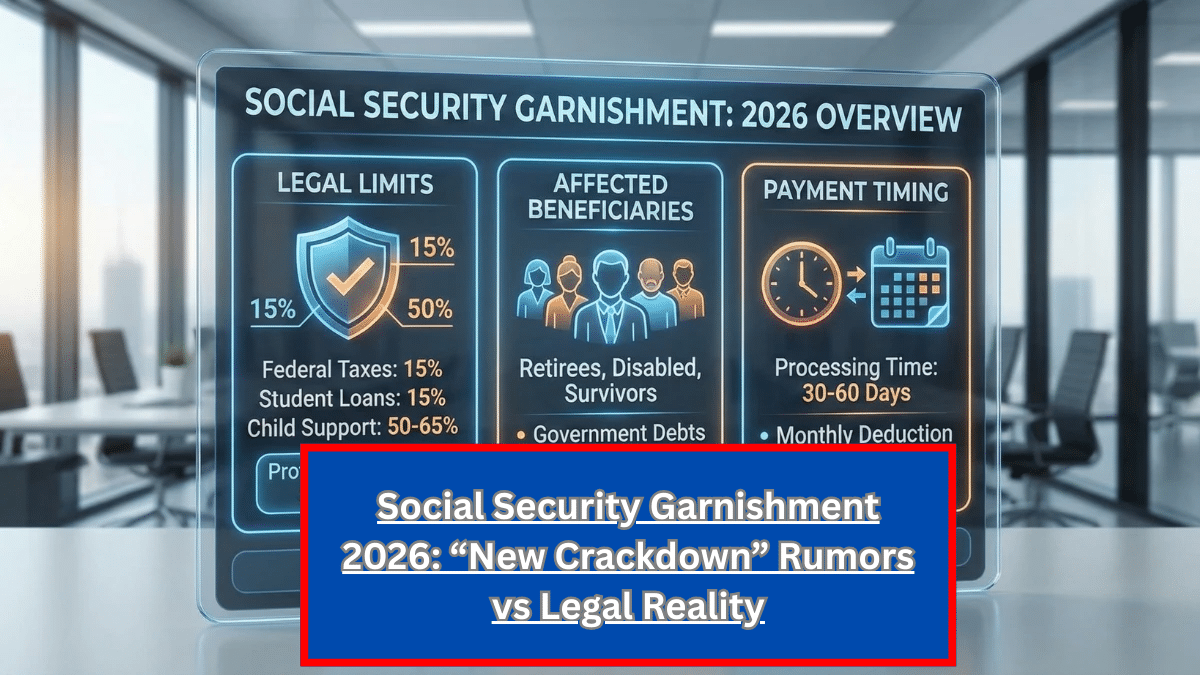

Who Is Actually Affected?

Only beneficiaries who owe qualifying debts—such as unpaid federal taxes or court-ordered child support—may be subject to garnishment.

This means:

- The majority of Social Security recipients are not affected.

- There is no automatic review of all beneficiaries.

- Garnishment does not apply randomly.

If a beneficiary has no qualifying federal or court-ordered debt, their Social Security payment remains fully protected.

How Much Can Be Garnished?

Federal law places strict limits on how much can be withheld. Garnishment is partial, not total.

A protected portion of the monthly benefit must remain available to the beneficiary. Social Security payments are never completely taken through garnishment.

The percentage withheld depends on the type of debt, but full seizure of benefits is not legally permitted under standard garnishment rules.

How Garnishment Is Applied and Timed

There is no separate garnishment payment schedule.

If garnishment applies:

- The withheld amount is deducted from the regular monthly payment.

- The remaining balance is deposited as usual.

- Beneficiaries receive advance written notice before withholding begins.

Written notice is legally required. Garnishment does not begin without prior official communication explaining the debt and the amount to be withheld.

Why 2026 Is Being Mentioned

Future years are often used in misleading online headlines to create urgency and attract attention.

However:

- No SSA notice links 2026 to new garnishment enforcement.

- No federal law expands garnishment authority in 2026.

- No new categories of beneficiaries are being added.

The mention of 2026 in alarming posts is not supported by official guidance.

What Has NOT Changed

- No new eligibility group has been added.

- No increase in garnishment authority has occurred.

- No automatic review of all recipients is taking place.

- No new payment seizure dates have been announced.

The same long-standing legal limits remain in effect.

What Beneficiaries Should Do

If you are concerned about garnishment:

- Carefully read any official written notice.

- Verify the source of the notice (SSA or Treasury correspondence).

- Be cautious of online messages suggesting immediate payment seizure.

- Contact SSA directly if you receive official documentation.

Unverified messages claiming sudden garnishment without written notice should be treated with caution.

Key Facts to Remember

- No new Social Security garnishment rules begin in 2026.

- Only specific federal debts qualify for withholding.

- Most beneficiaries are not affected.

- Advance written notice is required.

- Social Security benefits are never fully taken through garnishment.

Conclusion

Social Security garnishment in 2026 follows the same legal rules that have governed the program for years. There is no new enforcement wave, no expanded authority, and no surprise seizure program beginning this year.

Disclaimer

This article is for informational purposes only and does not constitute legal or financial advice. Social Security garnishment rules are governed by federal law and official government notifications.

Written by our editorial team, committed to accurate and responsible reporting.