When a deposit arrives earlier or later than expected, many recipients immediately worry about missing funds or benefit cuts. However, in most cases, timing shifts are caused by routine payment processing steps—not by lost money or policy changes.

Electronic payments move through multiple systems before reaching a bank account. Even when agencies release funds on schedule, processing timing can change at several stages between the sender, clearing networks, and banks.

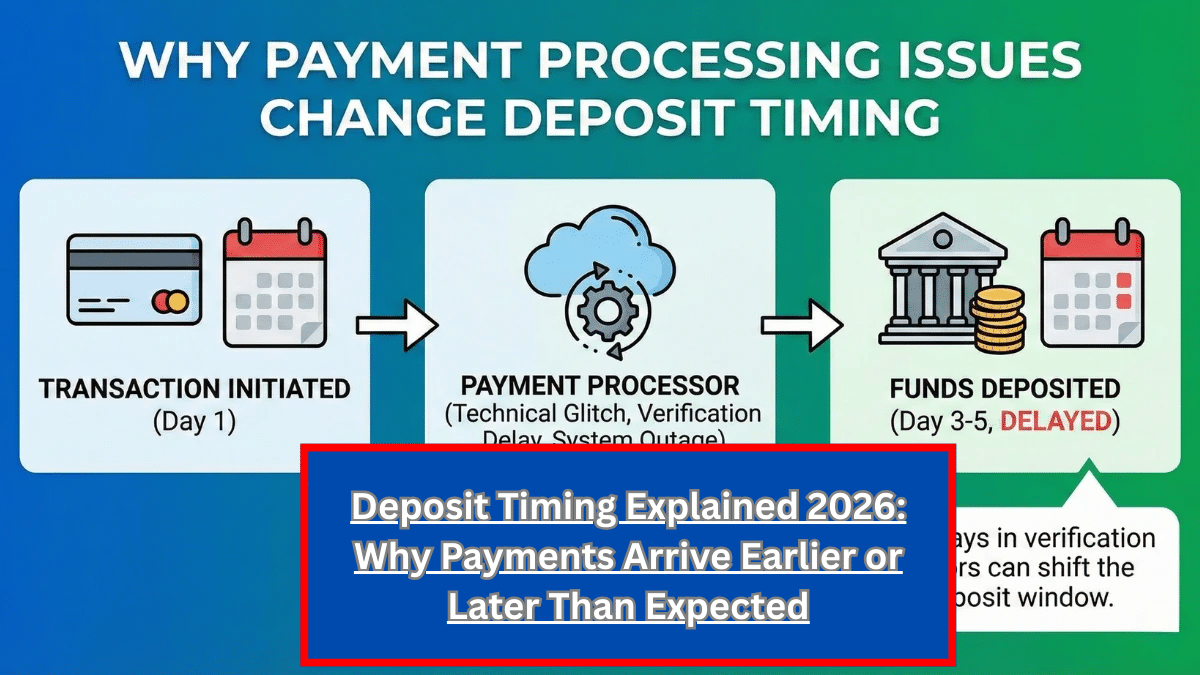

Understanding Deposit Timing Explained 2026 helps set realistic expectations. Agencies such as the Social Security Administration and financial institutions operate under long-standing processing frameworks. This article explains what payment processing issues are, why timing changes occur, and what recipients should expect under normal banking rules.

What Are Payment Processing Issues?

Payment processing issues refer to routine technical, verification, or settlement steps that occur after a payment is released but before it posts to a recipient’s bank account.

When a payment is sent:

- The sender releases the funds electronically.

- The payment travels through clearing networks.

- The receiving bank processes the transaction.

- The deposit is posted to the account.

At any of these stages, timing can shift slightly. These steps exist to ensure:

- Accuracy of routing information

- Identity verification

- Fraud prevention

- Compliance with banking regulations

- Proper settlement between institutions

Importantly, processing delays usually affect timing only, not the payment amount.

Common Reasons Deposit Timing Changes

Below is a breakdown of typical causes and their effects:

| Cause | What Happens |

|---|---|

| Bank processing cut-off times | Deposits post next business day |

| Weekend or holiday processing | Payments shift earlier or later |

| Verification checks | Temporary hold before posting |

| Payment network delays | Settlement timing changes |

| Account status issues | Deposit queued or returned |

Each factor reflects routine financial system operations rather than missing funds.

Bank Cut-Off Times Matter

Banks process deposits in daily batches rather than in real time. Each bank has a cut-off time for processing incoming transactions.

If a payment arrives:

- Before the cut-off time: It may post the same business day.

- After the cut-off time: It usually posts the next business day.

For example, if a deposit is sent late in the afternoon and the bank’s cut-off was earlier that day, the transaction will likely appear the following business morning.

This does not mean the payment was late—it simply missed that day’s processing window.

Weekends and Federal Holidays

Most payment systems do not settle transactions on weekends or federal holidays. If a scheduled payment date falls on a non-business day, the posting date may shift depending on the sender’s rules.

Common outcomes include:

- Payment posts the previous business day

- Payment posts on the next business day

- Payment appears pending until settlement resumes

Because banking systems close for official holidays, timing differences during these periods are normal and predictable.

Verification and Security Reviews

Banks and payment networks use automated systems to detect fraud and unusual activity. These systems sometimes place temporary holds on incoming deposits for review.

Verification checks may occur if:

- There has been a recent account update

- A deposit amount is unusual

- There is a name mismatch

- The account is newly opened

These reviews are generally brief and resolve automatically. They do not change the payment amount—only the posting time.

Security reviews are preventive measures designed to protect account holders.

Payment Network Settlement Timing

Electronic payments move through clearing networks before reaching individual banks. These networks coordinate the transfer and settlement of funds between institutions.

Settlement timing can shift due to:

- High transaction volume

- Routine system maintenance

- End-of-month processing loads

- National payment congestion

Even if a government agency releases funds on schedule, settlement timing may cause slight posting differences at individual banks.

Different banks may also display deposits at different times depending on their internal posting policies.

Account-Specific Issues

Occasionally, account-related factors can delay a deposit.

Examples include:

- Closed or inactive accounts

- Incorrect routing numbers

- Name mismatches

- Recently updated banking details

In such cases, the deposit may be queued or returned to the sender for correction. Once updated information is verified, funds are typically reissued.

These issues are administrative and do not represent benefit reductions.

Why Agencies and Banks May Show Different Posting Times

Agencies like the Social Security Administration release payments according to official schedules. However, once released, control shifts to financial networks and banks.

This can result in:

- The sender marking the payment as “sent”

- The bank showing the deposit as “pending”

- Final posting occurring hours or a day later

Differences in system timing between the sender and the bank can create confusion, even though the payment is moving normally through processing channels.

What Has Not Changed

To clarify common concerns:

- There is no new rule causing random deposit delays.

- Payment amounts are not reduced due to timing shifts.

- No penalties are applied because of processing steps.

- Long-standing banking rules continue to apply.

Deposit timing variations are part of established payment system operations—not policy changes.

What Recipients Should Do

If a deposit appears early or late:

- Allow at least one full business day for posting.

- Check for weekends or holidays affecting settlement.

- Review bank notifications or pending transactions.

- Confirm account details are correct.

Contact the sender only if the deposit does not appear after the adjusted business window has passed.

In most cases, deposits resolve automatically without intervention.

Key Highlights

- Processing timing can shift deposits without affecting payment amounts

- Bank cut-off times are a common cause of next-day posting

- Weekends and holidays alter settlement schedules

- Verification holds are temporary and security-based

- Most deposit timing issues resolve automatically

Conclusion

Deposit Timing Explained 2026 reflects the normal operation of electronic payment systems. When a deposit arrives earlier or later than expected, it is typically due to bank cut-off times, settlement timing, verification checks, or non-business day processing—not missing money or benefit cuts.

Disclaimer

This article is for informational purposes only and does not constitute financial or legal advice. Payment posting times depend on banking systems and official processing rules.

Written by our editorial team, committed to accurate and responsible reporting.