Tax refunds remain an important financial event for millions of Americans each year. As the 2026 tax season approaches, many taxpayers are looking for clarity on how IRS refunds work, when refunds are typically issued, and what factors can affect payment timing. Understanding the refund process helps filers avoid delays and set realistic expectations.

How IRS Tax Refunds Work

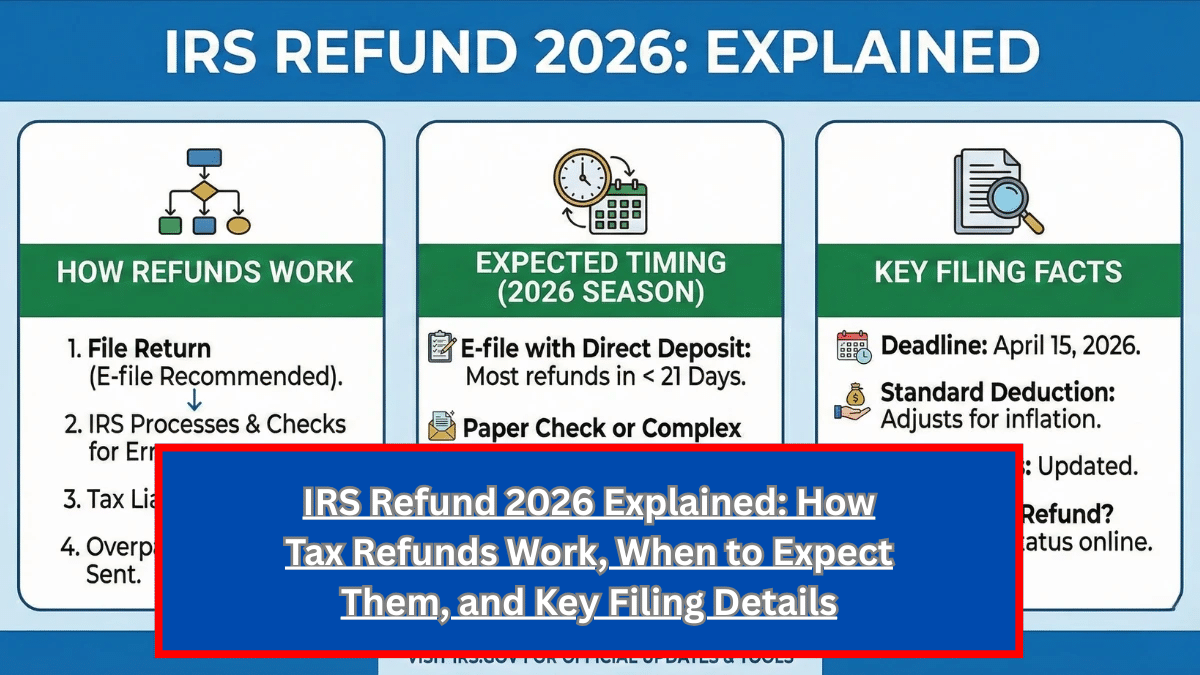

An IRS tax refund is issued when a taxpayer has paid more in taxes during the year than they owe. This can happen through paycheck withholdings, estimated tax payments, or refundable tax credits. After a tax return is filed and processed, the IRS calculates the final tax liability and determines whether a refund is due.

Refunds are not government bonuses or stimulus payments—they are simply the return of overpaid taxes. The amount depends on income, deductions, credits, and withholding levels.

Expected IRS Refund Timing in 2026

For most taxpayers who file electronically and choose direct deposit, refunds are typically issued within 21 days of the IRS accepting the return. Paper-filed returns usually take longer due to manual processing.

Refund timing can vary depending on several factors, including filing date, return accuracy, and whether additional verification is required. Returns claiming certain credits may also face mandatory processing delays.

Factors That Can Delay a Refund

Several issues can slow down the refund process. Errors on the tax return, missing information, or mismatched data may trigger IRS reviews. Identity verification requirements and fraud prevention checks can also extend processing time.

Additionally, refunds that include specific refundable credits may be held for extra review to ensure compliance with federal law.

The Role of Filing Method and Direct Deposit

Filing electronically significantly speeds up IRS processing compared to paper returns. Choosing direct deposit further reduces waiting time, as mailed checks require additional handling and delivery time.

Ensuring that bank account information is accurate is essential, as incorrect details can cause refunds to be rejected or delayed.

Key Filing Facts Taxpayers Should Know

Taxpayers should file complete and accurate returns, report all income, and double-check personal details before submission. Keeping tax records organized and responding promptly to any IRS requests can help prevent delays.

Filing early in the tax season may also reduce processing backlogs and improve refund timing.

What to Expect If a Refund Is Adjusted

In some cases, the IRS may adjust a refund amount due to calculation corrections or eligibility changes. If this happens, the IRS notifies the taxpayer by mail explaining the adjustment and the reason behind it.

Conclusion

IRS refunds in 2026 will follow the same basic process as in previous years, with timing influenced by filing method, accuracy, and verification requirements. Understanding how refunds work and what affects their release helps taxpayers plan more effectively and avoid unnecessary delays. Filing electronically, choosing direct deposit, and submitting accurate information remain the best ways to receive a refund as quickly as possible.

Disclaimer

This article is for informational purposes only and does not constitute tax, legal, or financial advice. IRS refund amounts and timelines depend on individual filings and official IRS procedures.

Written by our editorial team, committed to accurate and responsible reporting.