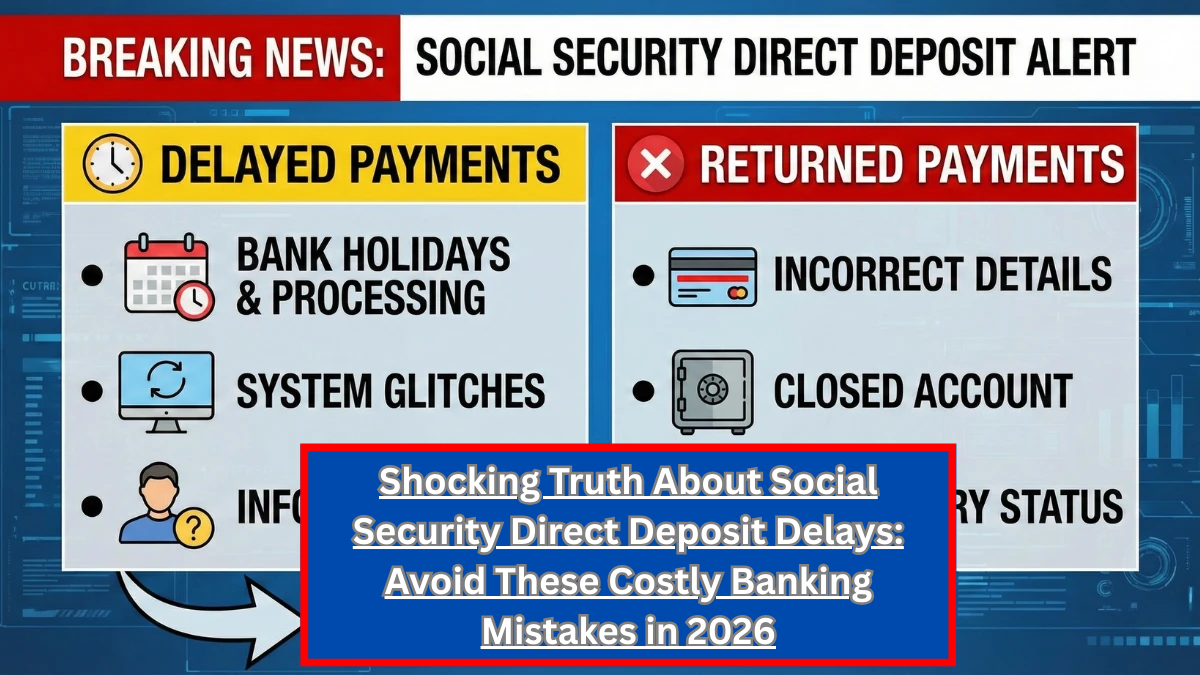

Direct deposit is considered the fastest, safest, and most reliable way to receive Social Security benefits. Millions of Americans depend on electronic payments every month for essential expenses like rent, food, medical bills, and utilities. However, when banking information is incorrect or account issues arise, payments can be delayed, returned, or temporarily interrupted.

Many headlines suggest sudden rule changes or benefit disruptions, but in most cases, delays are caused by simple administrative or banking errors. The Social Security Administration (SSA) continues to follow long-standing direct deposit procedures. This detailed guide explains how Social Security direct deposit works, the most common problems that cause payment delays, how to fix them quickly, and what beneficiaries must do to keep their payments on track.

Focus Keyword: Social Security Direct Deposit Problems 2026

Key Highlights

Issue | Impact on Payment

Incorrect bank details | Deposit rejected and returned

Closed bank account | Payment sent back to SSA

Name mismatch | Bank flags or rejects deposit

Recent bank change | Possible one-cycle delay

Account restrictions | Temporary hold on funds

Returned deposit | Reissuance process required

Why Social Security Direct Deposit Is Important for Beneficiaries

Direct deposit is mandatory for most recipients of Social Security benefits. The SSA encourages electronic payments because they are faster, more secure, and reduce the risk of lost or stolen checks. Once approved for benefits, payments are automatically sent to the bank account listed in the beneficiary’s record.

The SSA transmits payment instructions electronically to financial institutions. If everything matches correctly—account number, routing number, and account holder name—the funds are credited on the scheduled payment date. However, if the bank cannot process the transaction, it rejects the deposit and returns the funds to the SSA.

It is important to understand that payment delays due to direct deposit issues are not benefit cuts. They are processing interruptions that occur when banking information does not match official records or when accounts have restrictions.

How Social Security Direct Deposit Works Step by Step

The payment process begins when the SSA schedules monthly benefit deposits according to the recipient’s birth date or benefit category. On the scheduled date, funds are electronically transferred through the federal payment system to the designated bank account.

If the bank confirms the account is valid and active, the funds are posted. If the account number is incorrect, closed, frozen, or mismatched, the bank rejects the transaction.

When a deposit is returned:

• The SSA receives notification from the bank

• Payments are temporarily paused

• The beneficiary must correct account details

• The SSA reissues payment after verification

This verification process may take additional time, especially if identity confirmation is required. Therefore, accuracy in banking information is critical.

Most Common Social Security Direct Deposit Problems in 2026

Incorrect Account Number or Routing Number

Entering even one incorrect digit can cause the entire deposit to fail. Banks automatically reject transactions that do not match a valid account. The payment is then returned to the SSA, causing delays.

Closed Bank Account

If a beneficiary closes a bank account without updating SSA records first, the next scheduled payment will be returned. The SSA must then contact the recipient or wait for updated details before reissuing funds.

Recent Bank Account Changes

Switching banks close to a payment date can result in a one-cycle delay. The SSA requires processing time to verify the new account before sending funds. Changes should ideally be made several weeks before the next payment date.

Name or Ownership Mismatch

The name listed in SSA records must match the name on the bank account. While joint accounts are usually accepted, discrepancies—such as using a nickname or business account—may trigger rejection.

Bank Account Holds or Restrictions

Banks may temporarily freeze or hold funds due to suspected fraud, overdrafts, legal garnishments, or internal reviews. In these cases, the SSA sends the payment on time, but the bank restricts access.

What Has Not Changed in 2026

There are no new federal rules in 2026 that alter how Social Security direct deposit works. The Social Security Administration continues to follow long-established electronic payment regulations.

Claims suggesting that new nationwide policies are causing widespread payment delays are inaccurate. Most issues arise from individual banking situations rather than government rule changes.

SSA payment schedules remain the same:

• Payments are typically sent based on birth date

• Supplemental Security Income follows a separate schedule

• Electronic deposits remain the standard method

How to Fix Social Security Direct Deposit Issues Quickly

If your Social Security payment does not arrive on time, follow these steps:

Step 1: Check with Your Bank

Confirm whether the deposit is pending, on hold, or rejected. Sometimes deposits are delayed by internal processing times.

Step 2: Review Your Banking Information

Log into your SSA account or review official records to confirm your routing and account numbers are correct.

Step 3: Update Account Information Early

If you need to change banks, do so well before your next payment date. This helps avoid a skipped payment cycle.

Step 4: Contact the SSA

If the deposit was returned, contact the SSA to confirm when reissuance will occur. Be prepared to verify your identity.

Step 5: Monitor Future Payments

After correcting the issue, check your next payment carefully to ensure the problem has been resolved.

How Returned Deposits Are Reissued

When a deposit is rejected, the funds automatically return to the SSA. The agency must then:

• Verify the reason for rejection

• Confirm updated banking details

• Reprocess the payment

In some cases, the SSA may issue a paper check temporarily while updating electronic records. This process can take additional days or weeks depending on verification requirements.

Tips to Prevent Social Security Payment Delays

Prevention is easier than correction. Beneficiaries can avoid most direct deposit problems by:

• Double-checking routing and account numbers

• Avoiding last-minute bank changes

• Ensuring the account holder name matches SSA records

• Keeping accounts active and in good standing

• Monitoring bank notifications regularly

Being proactive significantly reduces the risk of returned payments.

Understanding the Role of Banks vs. SSA

It is important to distinguish between SSA processing and bank processing. Once the SSA sends the payment, responsibility shifts to the financial institution. If a deposit is delayed due to fraud review or overdraft issues, the bank—not the SSA—is controlling access to the funds.

Clear communication with your bank can often resolve confusion quickly.

Conclusion

Social Security direct deposit problems can temporarily disrupt payments, but they are usually administrative and fixable. In 2026, there are no new SSA rules causing widespread delays. Most issues stem from incorrect bank information, account closures, or verification mismatches.

Disclaimer

This article is for informational purposes only and does not constitute financial or legal advice. Social Security payment processing follows official SSA and banking regulations.

Written by our editorial team, committed to accurate and responsible reporting.